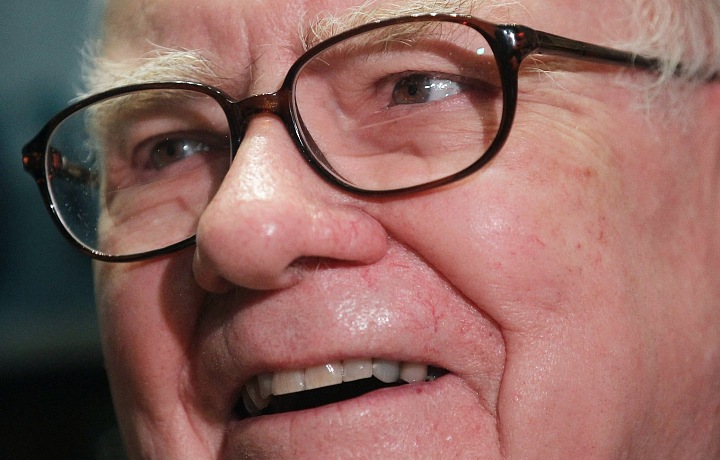

The investment world is losing its biggest star. Warren Buffett is packing it in at the age of 95.

The icon of modern investing Warren Buffett is retreating into seclusion after more than 60 years of business. He is handing over the reins of his company to Greg Abel, who is more than 30 years younger. What was the story of the man who gradually made 150 billion dollars and thus became the fifth richest man in the world? And did you know that he also left his entrepreneurial mark in the Czech Republic?

Famed investor Warren Buffett, who is also known as a strong opponent of increasing taxes for the rich and at the same time an opponent of the cryptocurrency bitcoin, has now decided to hang up his business. So, at the age of 95, he is passing the baton in his firm Berkshire Hathaway to 63-year-old Greg Abel, who has until now been the vice chairman of the board of his company Berkshire Hathaway. He announced this with sufficient advance notice already last spring, as reported by ČTK.

"I think the prospects of Berkshire will be better under Greg's leadership than under mine,"

Buffett said in this context.

A rich man with strong American roots

As a young man, Buffett liked to read and excelled in mathematics. The combination led him to investing. At the start of his career, when he had an office in his bedroom, he mainly multiplied the wealth of his relatives and friends. He started doing well. Thanks to his own resources, as the server Novinky.cz reminded, he gradually built up wealth, the amount of which Forbes magazine recently estimated at 150 billion dollars, or 3.1 trillion koruna in conversion!

A small part of this fortune also has a Czech background. Five years ago, one of his companies, which specializes in the production of refrigeration systems for gastronomy, rented 12,000 square meters of production and office space near the Brno Airport Tuřany. Also known is the producer of picture frames and mouldings Lira, which operates in Český Krumlov, or the tool company Iscar, whose domestic branch is based in Plzeň.

Buffett himself, however, avoided the Czech Republic. Just like most other European countries. Personally, in 2008 he visited only neighboring Germany, and also Italy, Switzerland and Spain. The long-time director of the company Lira František Jenerál told the magazine Ekonom that he tried several times to invite the investor to our country, but it never happened. However, he confirmed that the wealth he has achieved has definitely not gone to his head. When a Czech manager once met him in Florida, he described him as follows:

"He appeared as a jovial, normal man whom nobody would say is one of the richest men in the world,"

said to the economic magazine Jenerál.

Modern technology never really attracted Buffett

Since 1958, Buffett has been living in a house that he bought for $31,500. The value of the property has since increased more than tenfold to the current roughly $350,000, which is roughly 7.2 million crowns in conversion. When he was younger, he liked to stop for his favorite burger at McDonald's on his way to work. However, he is a teetotaller. He was also a passionate bridge player for a long time.

He is known for his aversion to new technologies. Yet in 2013, he set up a Twitter account to send his first message in the form of "Warren is home." He made another exception for investing in the Apple brand, where he owned just under 6 percent eight years ago. However, he gradually sold off part of his assets again. In addition to this, Buffett is one of the most famous opponents of the cryptocurrency bitcoin. He said years ago that if someone offered him all the bitcoins in the world for 25 dollars, he wouldn't buy them.

Betting on Long-Term Profit

Despite his conservative approach, he has always been an inspiration to those around him. He used to say that he looked at investing primarily from the perspective of long-term returns. In his letter to shareholders last year, among other things, he stated that the companies Coca-Cola and American Express, where he owns a stake, are “timeless essences of our world”. Instead of excessive diversification, he focused his efforts on several large companies with strong foundations, taking advantage of opportunities when their securities were undervalued. He always followed his own instinct. He never let himself be swept away by the crowd. Because he has consistently stuck to his strategy and been generally successful, he has always been considered the most influential investor in the world.

But he occasionally made losses as well. When selling shares in Bank of America, he reportedly lost about ten billion dollars. This happened after these securities subsequently increased by ten percent. Another example was the unsuccessful sale of stakes in four of the largest U.S. airlines - Delta Air Lines, American Airlines, Southwest Airlines and United Airlines. Airline stocks then collapsed after the downturn in air traffic due to the pandemic. However, as it turned out later, he got rid of these securities at the worst possible time. After that, shares in general, including the airline industry, recovered, he added in this connection magazine Forbes.cz.

Sources: author's text, CTK, Economist, Novinky.cz, Forbes